What can I say about my finances, other than they can only improve from this point forward.

I have a few different strategies for certain debts: statute-barred; repayment; DMP.

I used to be in a Debt Management Plan and I even had a DRO at one point but I never learned my lesson so it seems. Those that I’m not paying off I am going down the statute bared route & hoping that I make it through 6 years (1.4 years down). I am having issues with one account and I’m currently fighting a CCJ in court.

I wanted to make a post detailing my plans and making me accountable. I intend to update once a month on how everything is going.

Statute-barred

Creditors have to take legal action about debts within certain times which are set out in the Limitations Act 1980. For most sorts of debts and bills in England and Wales this time is six years.

If the creditor doesn’t start court action within this time, the debt is not enforceable because it is “statute-barred”. When a debt is statute-barred it still exists legally, but because you cannot be taken to court for it, you do not have to make any payments to it.

This six-year period begins when the creditor has a cause of action – this is the point at which the creditor could go to court for the debt.

If you are making the normal monthly payments to a debt, you can’t be taken to court for it. It is only when you have missed payments and the creditor can go to court that the 6-year period starts.

I am going this route for most of my closed & defaulted accounts. So far only one has taken me to court where I’m fighting a CCJ, the others either aren’t contacting me or are sending idol threats via text. I am counting down the months til I can say bye-bye to them.

If any of these come back and start threatening court, I will drag it out as far as I can then try to set up a DMP with them then look to offer full & final settlements down the line. I am going to do this alone and not through a fee-free company so I have full control over everything and can offer more money to one if I have some left over at the end of the month

- David Lloyd [gym] £580 – no longer on credit file – heard nothing [poss SB]

- Trugym [gym] £86 – no longer on credit file – heard nothing [poss SB]

- Lending Stream [PD] £86 – no longer on credit file – heard nothing [poss SB]

- QuickQuid [PDL] £539 – taking me to court

- Natwest [Loan] £4888 – Default on file – treats by text [1.4/6 SB]

- Natwest [OD] £766 – Default on file [1.4/6 SB]

- Very £766 – Default on file – treats by text/letter [0.11/6 SB]

- JD Williams £1241- Default on file – unenforceable [1/6 SB]

- Cash Plus [card] £280 – Default on file [1.4/6 SB]

DMP

A debt management plan (DMP) is a debt solution that can be used to help people pay back their debts at an affordable rate. It’s normally suitable for someone struggling to meet the repayment amount they originally agreed with their creditors.

I have no debts under this arrangement as yet but I do have all documentation ready to sent if/when needed.

Repayments

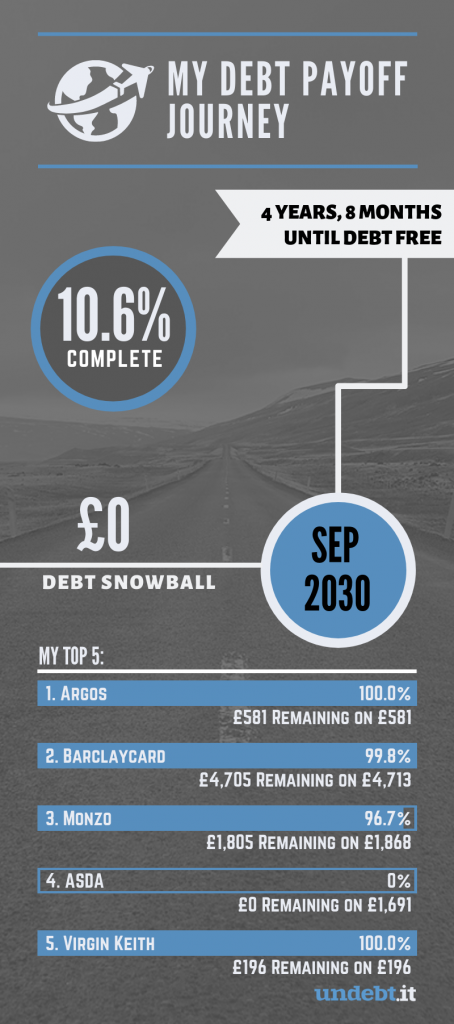

I have 4 debts that I am doing to this with after they default. All to be repaid ASAP

- Marbles 741 – £50 a month – 15 months

- Aqua 285 – £25 a month – 12 months

- Uncle Buck 632.72 – £25 a month – 25 months

- SafetyNet Credit 1250 – £50 a month – 25 months

One day I may actually learn my lesson. Today is the day…I would like to possibly get a mortgage by the time I’m 45 (2026) and need all defaults off my file by then.