Debt used to feel like background noise in my life—always there, quietly stressful, and impossible to ignore. At my peak, I was juggling 15 different credit accounts with a total of £15,486 owed. Credit cards, store cards, buy-now-pay-later, overdrafts—you name it, I probably had it.

For a long time, I didn’t really have a plan. I was making minimum payments, shifting balances around, and hoping future-me would magically fix it.

Spoiler: that doesn’t work.

Everything changed when I finally got honest with myself, built a real system, and committed to seeing it through.

The Tools That Changed Everything: YNAB + undebt.it

Two tools completely transformed how I manage money.

YNAB (You Need A Budget)

YNAB forced me to face reality. No guessing, no vibes-based spending—just real numbers.

It helped me:

- Give every pound a job

- Stop overspending before it happened

- Plan for true expenses

- Break the paycheck-to-paycheck cycle

Instead of reacting to money problems, I started planning for them.

undebt.it

This is where my debt payoff became visual and motivating.

I use undebt.it to:

- Track every balance

- Run payoff scenarios

- See my snowball progress

- Stay focused on the end date

Seeing my progress laid out clearly made a massive difference.

Where I’m At Right Now

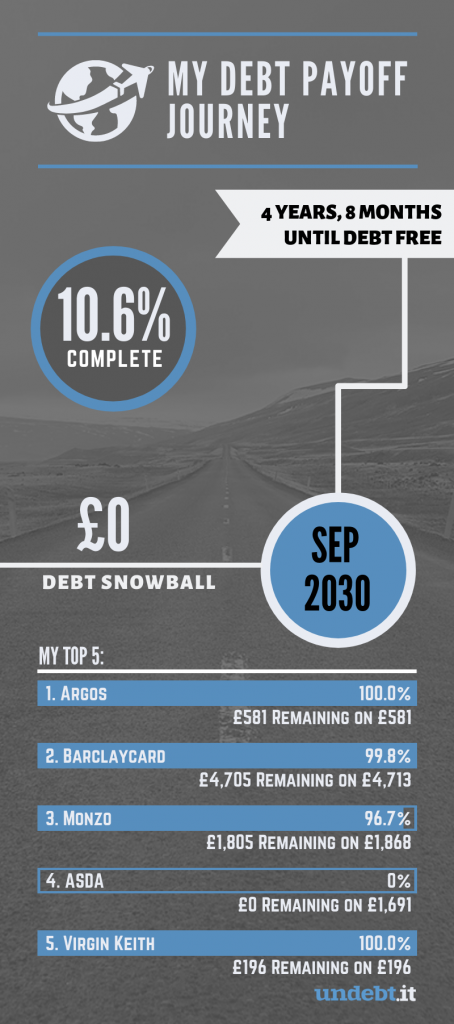

Here’s a snapshot of my current journey:

- Total debt when I started: £15,486

- Number of accounts: 15

- Method: Debt Snowball

- Tools: YNAB + undebt.it

- Progress: 10.6% complete

- Debt-free goal: September 2030

📊 My Current Progress

Why I Chose the Debt Snowball Method

I know mathematically the avalanche method saves more in interest—but mentally, I needed quick wins.

The snowball method works for me because:

- Small wins build motivation

- Paid-off accounts reduce mental load

- Progress feels tangible

- I stay consistent

Every time one balance hits zero, it fuels me to keep going.

The Hardest Part: Facing the Numbers

Honestly? The hardest part wasn’t paying—it was looking.

Seeing all 15 balances listed out was uncomfortable. But clarity gave me power. Once I knew exactly what I was dealing with, I could finally make informed decisions.

No more avoidance. No more guessing. Just data.

What I’ve Learned So Far

This journey has already taught me a lot:

✔ Progress beats perfection

✔ Systems matter more than motivation

✔ Visibility changes behavior

✔ Small wins compound

✔ Debt freedom is built, not wished for

Why I’m Sharing This Publicly

I’m documenting this journey not because it’s perfect—but because it’s real.

If you’re drowning in balances, avoiding your statements, or feeling like you’ve messed up too badly to fix it: you haven’t.

I’m proof that you can start messy and still succeed.

What’s Next?

My long-term goals go beyond being debt-free:

- Build a full emergency fund

- Start serious investing

- Create true financial freedom

- Live with less stress

- Stop giving my future income to past decisions

Debt freedom isn’t the finish line—it’s the starting point.

Want to Follow My Journey?

I’ll be sharing regular updates, real numbers, wins, setbacks, and lessons learned along the way. If you’re on a similar path—or thinking about starting—I hope this helps you feel less alone.

💙